- Data Are Fast – A single will have to be a part of very long manual calculations so you’re able to arrived at their tax deductions at home loan cost. This really is go out-ingesting and you can problematic for many of us. That have a tax work for calculator during the the convenience, taxpayers normally learn the obligations most readily useful. More over, they could measure the matter they find yourself protecting on the taxation payments with their existing home loan expenses.

- Answers are Usually Direct – You to definitely mistake during these data can also be get-off your own income tax payment preparations jeopardized. When the time comes to clear your fees, you could find large debts than what you presumed prior to. Hence, to stop eg products of harvesting up, you could potentially apply a mortgage tax benefit calculator. Inside, a chance of errors otherwise mistakes are eliminated, causing you to be having an insight into the actual tax liabilities just after applying the tax rebates because applicable.

- A simple to Read Software – Using for example good calculator is extremely simple, as a consequence of a streamlined user interface. Also individuals with never used instance an internet equipment would be safe when using it for the first time. Hence, for example a beneficial calculator ensures restricted difficulty having an assessee, permitting him to evaluate obligations.

Although this calculator normally dictate discounts centered Cleveland Ohio unsecured personal loans for fair credit on your property loan words, it can’t measure most income tax-discounts owing to channels.

Nonetheless, once the a borrower, you need to see the exact tax rebate with the home loan established in your qualifications prominent payment and desire dues.

Home loan Tax Experts

To get a home is probably group?s dream and is also believed the most important financial purpose. The feeling out-of accomplishment and you can comfort that comes with managing a domestic is valuable. Regardless of whether you order or make a home, you will be making a primary expense.

In order to encourage men and women to pursue the imagine owning a home, numerous areas regarding Tax Work 1961 support an excellent taxation deduction for various elements of the acquisition otherwise construction regarding a house, mostly when the a mortgage is actually removed. If you are planning to shop for property in the future, here’s a fast book with the available tax experts.

Since the home financing borrower, you can allege income tax difference with the prominent cost yearly around Part 80C, desire payments less than Part twenty four (b), and an added bonus for the focus below Part 80EE for many who are a primary-time homebuyer.

- Home loan

- Mortgage Against Assets

- Harmony Transfer

Glance on Tax Advantages towards the Financial having FY 2022 – 23

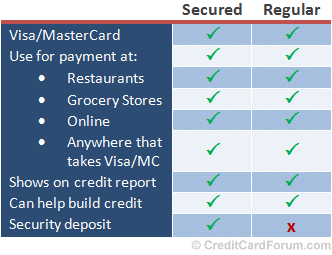

The latest dining table less than offers a fast overview of just how much you can save for the income tax together with your mortgage:

Financial Taxation Benefit Lower than Area 80C

Brand new Point 80C of money Tax Act allows home loan consumers to help you claim income tax deduction out of upto Rs 1.5 lakh for the dominant number reduced for the season.

- The construction of the property need to be accomplished upfront stating deduction lower than Point 80C.

- You shouldn’t transfer / promote the home inside 5 years out-of palms. If the marketed inside five years, most of the write-offs you’ve got currently said could be considered as your earnings around of your sales out of possessions.

Mortgage Tax Advantages Around Area 24(b)

Beneath the Section twenty four(b) of one’s Taxation Operate, you can allege taxation deduction regarding upto Rs 2 lakh for the appeal payments on your financial.

- It restriction from Rs dos lakh can be applied only when the house or property is actually mind-filled.

- In the event your home is leased aside (or otherwise not care about-occupied), there is absolutely no limit limit for claiming focus.

Leave A Comment